Financial fraud is a reality for many people. To avoid falling prey to fraud, it is important to be informed about security best practices to avoid fraud. Some helpful tips include:

Start by making sure all your bank accounts, credit cards and other financial instruments are protected with strong passwords. Never share your passwords with anyone, even if the requester appears genuine. Use unique passwords for each account and don't store passwords on websites or mobile devices.

Monitor your accounts frequently to check for suspicious activity. Confirm that charges are correct and payments are being made to the correct person or company. If there is anything suspicious, contact your bank immediately.

What is financial fraud?

Financial fraud is a crime that involves obtaining funds or property through deceptive or fraudulent tactics. These tactics may include the use of credit cards, which are issued with false information, stealing confidential customer information, etc. The goal is to profit from the illegal use of private information for personal gain.

How to prevent financial fraud?

The best way to prevent financial fraud is to be informed. It is important for consumers to understand how banks work and how to protect their financial data. It is always important to be aware of activity on bank statements and to know personal identification to avoid identity theft.

Another way to prevent financial fraud is to be careful when sharing information and documentation related to your finances. Do not share your credit card number or password with anyone other than an official banking institution. Be on the lookout for suspicious emails or phone calls that appear to be scams.

There are also some additional preventative measures consumers should take to protect themselves from financial fraud. For example, always update anti-malware software and devices to ensure adequate defense against external threats. Also, look for information about the organization or company that is doing business with you to make sure it is legitimate.

What are the types of financial fraud?

Financial fraud exists in a variety of forms. These include identity theft, money laundering, credit card fraud and phishing. Each of these has the potential to harm your financial situation and the security of your data. Therefore, it is important to take precautions to avoid falling victim to these types of activities.

What are the consequences of financial fraud?

Financial fraud is one of the most serious crimes and its consequences can be very serious. One of the main consequences is the loss of money, as criminals take advantage of the naivety and trust of the victims to take the money. This can have a major impact on the financial situation of the victim and his or her family.

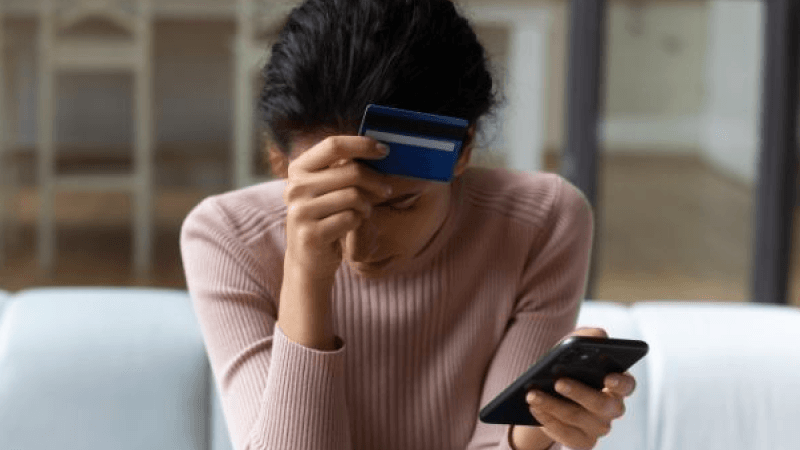

Another consequence of financial fraud can be stress and anxiety. Victims often feel overwhelmed by the situation, even if the fraud is not extremely costly. These feelings are common due to the sense of guilt or shame they experience for having fallen into a trap so easily.

Finally, it should be noted that financial fraud can have an impact on a person's credit. If the victim does not take steps to repair the damage done, it could affect their ability to obtain loans or credit cards in the future.

How to Report Financial Fraud

It is important to be aware of the financial fraud methods that criminals use to get their hands on people's money. Therefore, it is essential to know how to report this type of crime. If you suspect you have been the victim of a financial scam, it is important to contact the appropriate regulatory agency, such as the Federal Financial Protection Authority (CFPB), the Federal Trade Commission (FTC) or your local prosecutor's office. Public reports help government agencies detect and combat financial fraud.