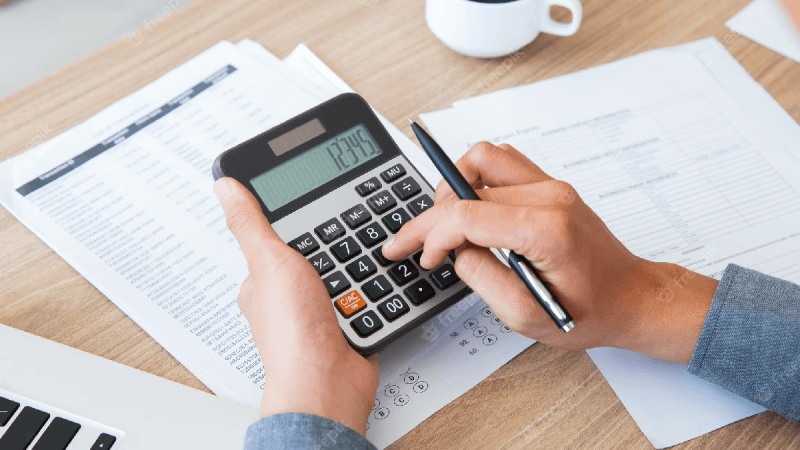

Myths about money and saving are common in all parts of the world. Many people believe that saving money is a difficult task or that you need a large amount of money to start saving. However, there are certain truths about money and saving that can help you better understand how it works.

Myths

Myths about money and saving are multiple, sometimes even contradictory. Some say you shouldn't spend too much, others say you need to spend to grow your economy; some recommend saving without limits, while others say you should save just enough. There is no single right answer, each person must find his or her own balance.

Saving is impossible

Savings are essential to financial success, but saving is possible, not impossible. Exploiting the benefits of financial planning and savings products can help you save a little each month to reach your financial goals. Setting realistic goals, developing a budget and finding ways to reduce unnecessary expenses are good steps to start.

Being rich means being happy

Many people believe that having a lot of money will make them happy. This popular belief is false, as happiness cannot be bought. Money is a means to an end, but not an end in itself.

Although having a lot of money can help you achieve goals and desires, it does not guarantee happiness. The key to happiness is the balance between satisfying material needs and seeking personal fulfillment. Material wealth is only a small part of happiness.

Spending money increases happiness

It is a common myth that spending money increases happiness. This is true to some extent, but many times overspending can lead to financial problems. The reality is that material goods do not bring lasting happiness. The real goal is to find balance between spending and saving to achieve a sustainable balance.

Truths

Saving is always a good option to reach your financial goals. It is important to set a budget and stick to it in order to save. Every time you save money, you turn it into an investment in your future. This will allow you to have a financial cushion for unforeseen situations and to reach the financial goals you have set. In addition, saving is the best way to plan your future financially because it gives you peace of mind and security.

It is true that money cannot buy happiness, but it does help improve your quality of life. Money can provide you with a more comfortable standard of living and even allow you to fulfill your dreams. The more you save, the more you can invest in things that generate happiness such as travel, recreational activities or unique experiences. Therefore, money can be a useful tool for creating meaningful experiences.

Money does not buy happiness

The commonplace that money doesn't buy happiness is true. Money can help us fulfill our basic needs and material desires, but often the sense of purpose and meaning in life is lost. Financial wealth does not always translate into happiness because, to be truly happy, one also needs to feel connected to others.

The real value is in interpersonal relationships. Strong bonds with friends and family are vital to a person's happiness. Shared experiences are invaluable, as is the mutual love and support given and received among loved ones. These things are what truly bring satisfaction.

On the other hand, money is necessary to live comfortably. However, there are many more important things in life than money, such as hard work, good habits and personal development. These are the things that help us to be happier and more satisfied with our lives in the long run.

Saving is possible

It is true that saving is possible. There are always ways to save money, such as buying products on sale or taking advantage of discounts. This helps us to have money saved for those situations when we may need it. We can also save money by using credit cards, which offer flexible payments and sometimes low interest rates. Finally, it is important to keep in mind that saving is a form of investment and an important part of financial planning.

It is important to establish priorities for saving

Setting priorities for saving is important. We must first consider what we need and what we want. This will help us decide which things are most important to us and where we should save. We must prioritize our income and expenses, separating essentials from non-essentials.

A good way to save is to create a budget. This will help us identify our monthly expenses, reducing unnecessary costs and establishing a "safe" amount of the amount we need. A budget also helps us set goals for the future, such as a new vehicle or house.